Confirmation of Payee

Home » Our Work » Overlay Services » Confirmation of Payee

Confirmation of Payee (CoP) is an account name-checking service designed to help reduce misdirected payments and provide greater assurance that payments are being sent, and collected from, the intended account holder for UK domestic payments. Owed to its high and valued effectiveness, CoP has quickly become a utility service that customers expect to see when making a payment to an account they have not previously paid in to.

Since launching in 2020, over 100 organisations have already implemented CoP, with more than 1.9m checks being completed every day. This widespread adoption of the service, and the Payment System Regulator’s mandate for almost 400 organisations to join CoP in 2024, are testament to the value of the service and its recognised importance as an anti-fraud tool. You can find out more about PSR SD17 here.

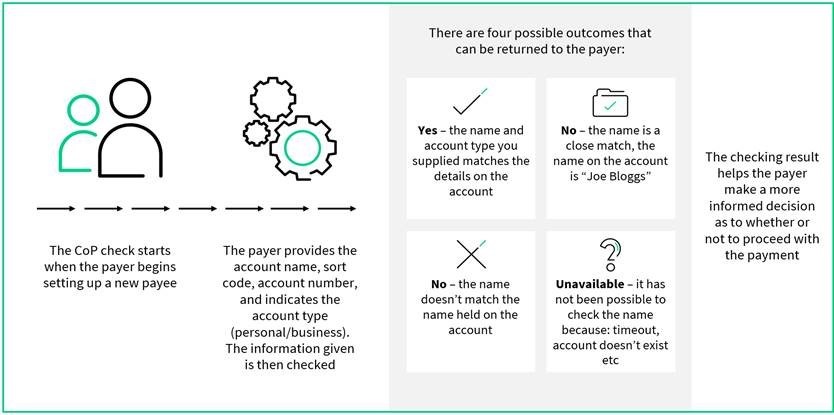

How Confirmation of Payee works

CoP allows an account name to be checked (including a personal and business account indicator) before initiating or collecting a payment.

CoP is an API-based peer-to-peer service, with no central infrastructure in place.

Participating in Confirmation of Payee

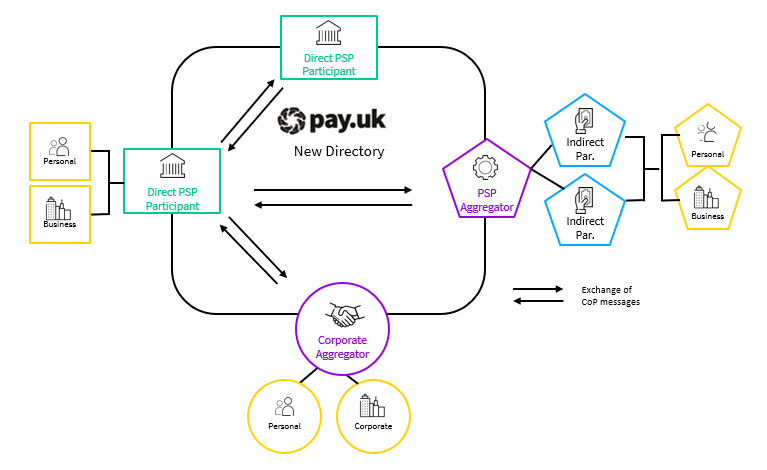

An organisation can join CoP either directly or through an Aggregator.

Direct model

- Be FCA or NCA regulated and authorised to perform payment service activities

- Be an account holding PSP that has customers (personal or business) reachable by a sort code and account number

- Not own their own sort code, but offer accounts addressable by Secondary Reference Data (SRD). Be named by PSR on the SD17

- Other criteria includes organisation named by PSR on the SD17 i.e. who own their own sort code in the EISCD.

If an organisation meets these requirements, it can either build its CoP solution in-house or through a third-party CoP solution provider that meets Pay.UK requirements.

Aggregator model

Details of how to onboard via our new Aggregator model are now available. For further information on either onboarding method, to be shared, please contact us at CBDO@wearepay.uk.

The diagram below shows how the model will be connected. It does not show an exhaustive list of connections.

In September 2023 we announced that we would be implementing the introduction of a CoP directory within our fraud programme. In January 2024 we further announced our directory service provider and gave details of our expected timelines for implementation and transition of activities to the new directory.

Customers can apply to join the new directory from April 2024.

Any customers intending to join the existing directory must go live and connect to it by 17 May 2024.

If you are currently in the process of onboarding, or have applied to onboard, please get in touch to advise if you can achieve the 17 May 2024 deadline.

Payer Name Verification

Payer Name Verification (PNV), reaps further benefits to those offered by Confirmation of Payee (CoP). Available to our existing CoP customers, this supplementary service allows organisations to perform account name-checking before setting up or amending Bacs Direct Debit payments. PNV therefore serves to ensure that payments are collected from the correct account number, reducing the risk, and subsequent associated costs, of misdirected payments.

Both customers and end users will benefit from improved first-time set-up rates as well as lower rejection rates. The service will also help to reduce Direct Debit fraud when setting up new Direct Debit instructions, as well as the risk of Direct Debit indemnity claims.

If you are interested in learning more about Payer Name Verification, please contact us at CBDO@wearepay.uk.