Request to Pay

Home » Our Work » Overlay Services » Request to Pay

What is Request to Pay?

Request to Pay is an overlay messaging service that sits within existing payments infrastructure. It is available to organisations that can incorporate it into their apps and services, and sits alongside Direct Debit and other existing bill payment methods to give consumers and businesses additional choice and flexibility when managing their finances.

When utilised, Request to Pay allows businesses to issue bill payment requests, and to communicate with bill payers, via a secure channel. The service helps to reduce the issues that arise when paying and collecting payments, including reconciliation costs and the resources required to chase unpaid amounts. It proposes to give businesses flexibility and control in managing payments and finances.

Both the Payment Systems Regulator and the Government’s Future of Payments review suggest that Request to Pay can offer much needed optionality for consumers and help them manage monthly budgets. Already, technical and service providers are part of the Request to Pay ecosystem and we continue to work in consultation with consumers, banks, fintechs and utility companies on changes to the proposition to ensure optimum uptake.

If you would like to discuss how you can get involved with Request to Pay, please contact rtp@wearepay.uk.

How Request to Pay works

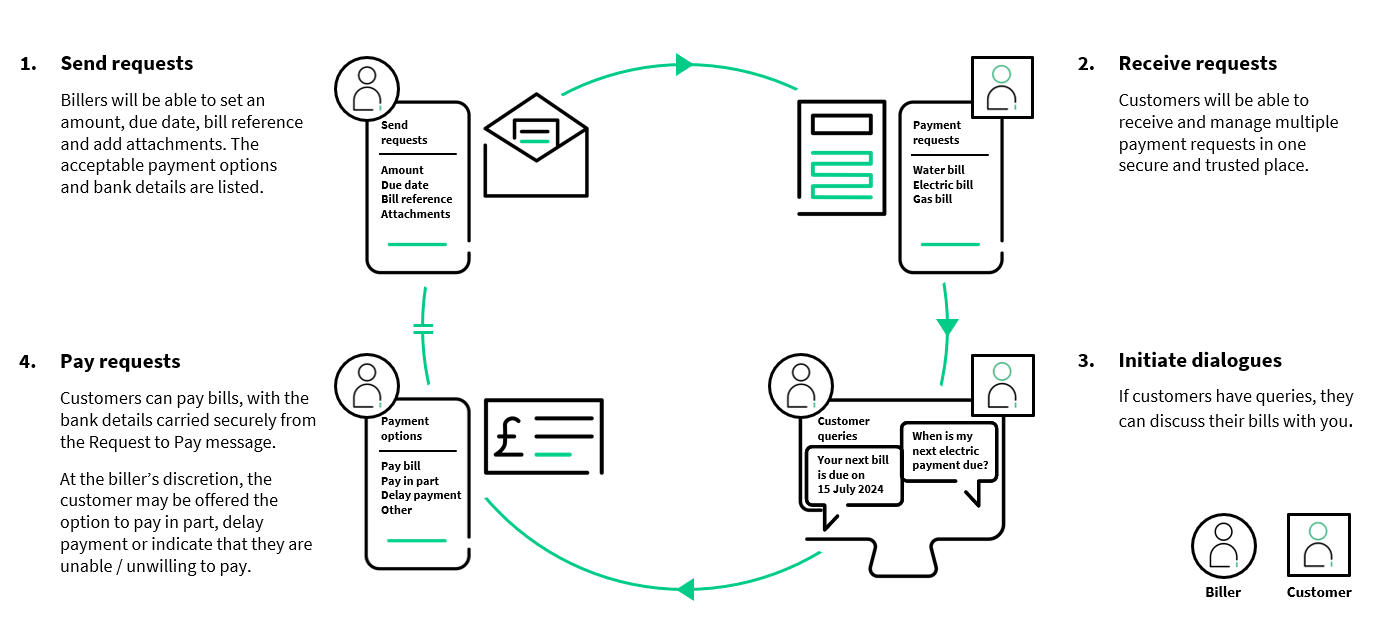

Request to Pay is designed to complement existing bill payment methods including Direct Debit, regular, and one-off bill payments. It allows billers to send secure messages to their bill payers when requesting payments. When the service is utilised, bill payers are given the option of either paying their bills via their preferred method or communicating with the biller directly with any queries.

All payment requests and communication channels between billers and payers happen in a secure framework that can sit within existing apps and services. A bill payer’s response to payment requests would not change their legal obligations.

Key features of Request to Pay

When using Request to Pay, billers are be able to send a secure message that asks their bill payer for payment. The bill payer can choose to pay that bill via their preferred method, or if they have a query, to communicate with the biller.

The request to make a payment and the channel for communication between billers and payers, happen in a secure framework that sits within existing payment apps and services.

In addition to making a request for payment and enabling bill payers and billers to communicate, billers can also choose to incorporate up to three other options for their bill payers:

- Pay part: This gives bill payers more flexibility and avoids complete non-payment by bill payers

- Pay later: This agrees to delay payment and enable bill payers to manage their own funds and avoid late payment fees. Agreeing a new payment date is likely to be better for billers than simply not receiving a payment when it is expected

- Decline to pay: This is an option for bill payers if they do not recognise the payment request. This can trigger a dialogue between the biller and bill payer to resolve issues more simply and cheaply than via current channels.

Participating in Request to Pay

If you are interested in participating in Request to Pay, please contact rtp@wearepay.uk.

To view the draft specifications for the Request to Pay Framework and find out more, please email CBDO@wearepay.uk.

If you are interested in other Pay.UK products or services such as our anti-fraud programme or Confirmation of Payee, our business development colleagues are here to help at: CBDO@wearepay.uk.