FAQs

Home » Our Work » Overlay Services » Confirmation of Payee » FAQs

Common Confirmation of Payee questions answered

What is Confirmation of Payee?

Confirmation of Payee is an account name checking service designed to help reduce misdirected payments, and provides greater assurance that payments are being sent and collected from the intended account holder for UK domestic payments.

How does Confirmation of Payee work?

When setting up a new payment, a payment services provider (PSP) will be able to check the name, sort code, account number, plus, if applicable, secondary reference data such as a building society roll number, and type of account of the person or organisation that their customer is asking to pay, against the details held on the account.

There are four possible outcomes:

Yes – If the customer has used the correct account name, they will receive confirmation that the details match, and can proceed with the payment.

Close match – If the customer had used a similar name to the account holder, they will be provided with the actual name of the account holder to check. They can update the details and try again, or contact the intended recipient to check the details.

No, the name is wrong – If they have entered the wrong name for the account holder they will be told that the details do not match and advised to contact the person or organisation they are trying to pay.

Unavailable – This occurs when it is not possible to check the name, for example as a result of timeout, customer opt-out or if the account doesn’t exist.

What name should be used for Confirmation of Payee?

- To pay a personal account, the PSP’s customer will need the exact name registered to the account when making a payment, as well as the sort code and account number.

- If it is a joint account, a PSP’s customer will only need to provide one of the names registered to the account, however they may choose to provide both names. The order that a name appears on a joint account will not affect the matching response.

- To pay a business account, the PSP’s customer will need the registered business name or a trading name register to the account.

What is Pay.UK’s role in Confirmation of Payee?

As the Payment Systems Operator (PSO), Pay.UK has created the rules and standards for the Confirmation of Payee overlay service, and owns the product, including the ongoing service developments, innovations and industry communications.

What are the benefits of Confirmation of Payee?

Confirmation of Payee will help UK banks, building societies and other PSPs to reduce certain types of fraud and misdirected payments. In particular, it addresses certain types of authorised push payment (APP) fraud by providing a platform for PSPs to provide effective warnings to payers about the risks associated with progressing with a payment to an account where the name does not match.

What are the benefits of Confirmation of Payee to PSP’s customers?

Confirmation of Payee will give PSP’s customers greater assurance that their payments are being routed to the intended recipient and therefore are not being accidentally or deliberately misdirected.

CoP is now considered a hygiene factor within the payments industry and end users now expect to see a CoP check prior to making payments.

Will using Confirmation of Payee ensure customers are reimbursed if a payment is discovered to be fraudulent?

While Confirmation of Payee will provide an extra level of reassurance to PSP’s customers, it does not automatically guarantee that a fraudulent payment will be detected and that the customer, if they fall victim to fraud, will be reimbursed.

Who currently offers Confirmation of Payee?

CoP is offered by more than 110 banks, building societies and PSPs offer the Confirmation of Payee service to their customers. It is expected that all banks, building societies and PSPs have all their channels support CoP.

If an organisation is not offering CoP, the requester of the CoP check will receive an ‘unable to be checked’ message.

Who is eligible to apply to join Confirmation of Payee?

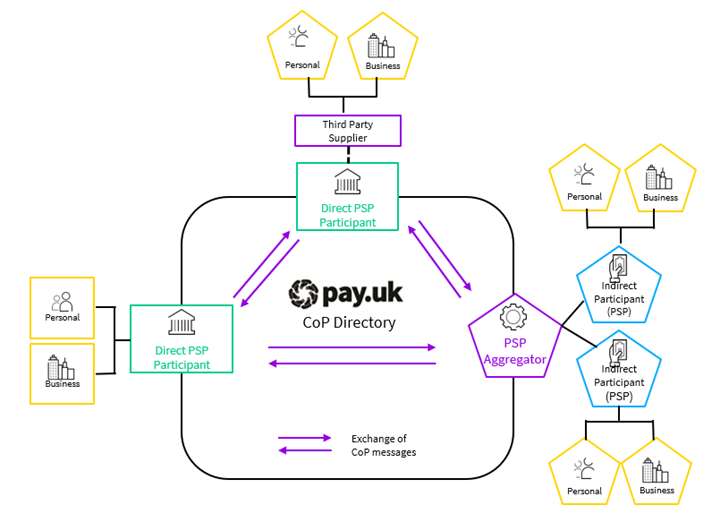

An organisation can join Confirmation of Payee either directly or through an Aggregator.

Direct model

- To join the Confirmation of Payee service, organisations must be FCA or NCA regulated and authorised to perform payment service activities

- The organisation must be an account holding PSP that has customers (personal or business) reachable by a sort code and account number

- Organisations that do not own their own sort code, but offer accounts addressable by Secondary Reference Data (SRD).

If an organisation meets these requirements, they can either build their CoP solution in-house, or through a third-party CoP solution provider meeting Pay.UK’s requirements.

Aggregator model

Details of how to onboard via our new Aggregator model are now available. For further information on either onboarding method, to be shared, please contact us at CBDO@wearepay.uk.

How can my organisation join Confirmation of Payee?

If you are interested in participating in Confirmation of Payee, contact us for more information.

What payment types are covered by Confirmation of Payee?

Confirmation of Payee is a payments agnostic overlay service for domestic UK-based payments and can be offered to CHAPS, Faster Payments and Bacs payments (debit and credit).

What is Payer Name Verification?

Payer Name Verification (PNV) is an optional service which allows organisations to perform account name checking before setting up or amending Bacs Direct Debit payments.

Will payments that are already set up be checked by Confirmation of Payee?

Confirmation of Payee checks new payees that are set up and the amending of details for existing payments. Payments to existing recipients and standing orders may not be checked using Confirmation of Payee although individual PSPs may check the details of existing recipients with Confirmation of Payee.

Will Confirmation of Payee stop fraud?

Confirmation of Payee is not a silver bullet to eradicate fraud but it is one of a range of measures being implemented by the industry to combat fraud. If you want more information about how the industry is helping end-users stay safe from fraud visit here: https://www.takefive-stopfraud.org.uk/.

What support is available to vulnerable customers?

The banking and finance industry is committed to looking after every customer, especially those in vulnerable circumstances. Confirmation of Payee has been developed by account providers in line with their company policies on providing for these vulnerable customers and those with additional access needs. This includes integrating Confirmation of Payee within existing accessible channels and providing additional support, where necessary, for those who may struggle to use Confirmation of Payee.

What is the reference that is asked for in some Confirmation of Payee checks, and when is it required?

For most accounts, all the information needed to complete a Confirmation of Payee check is a sort code, account number, and payee name. However, some accounts require a reference to be entered for the payment to be applied to the final account, for example, a 16-digit credit card number when paying a credit card bill, or a roll number for some building society accounts. This is called Secondary Reference Data (SRD).

For these accounts, when a PSP’s customer enters a sort code and account number for an applicable account, the Confirmation of Payee check will use the reference to ensure the account name is correct. If the details entered into the reference box are invalid or not recognised by the receiving payee Bank, the PSP’s customer will be informed and requested to check the details.

PSP’s customers attempting to pay these accounts will continue to see an error message regardless of if the correct SRD was entered.

What payee name should customers use when paying an account that requires reference data?

PSP’s customers need to ensure that they use the correct payee name and reference when setting up a new payment that requires a reference as part of the CoP check.

When a PSP’s customer is making a new payment to a building society account that requires a roll number, they should enter the account holder’s name in the payee field (not the name of the building society receiving the payment).

When a customer is making a new payment to a credit card or other payment account (e.g. from the major beneficiaries’ biller list), they should enter the account holder’s name in the payee field (not the name of the company receiving the payment).

What is PSR Specific Direction 17 (SD17)?

The Payment Systems Regulator issued Specific Direction 17 in October 2022 requiring directed PSPs to provide Confirmation of Payee. You can find out more about Specific Direction 17 here.

SD 17 requires the named organisations to implement CoP by October 2024. Pay.UK is seen as an enabler to create alternate models for CoP to support organisations to join the service. It is our role to define and implement this process and that is being finalised – it will ensure a level playing field so any interested aggregators can apply to participate.

If you are currently considering applying for CoP, please contact us for more information.

What is the Aggregator model?

The Aggregator model is a new model which is being designed to allow more organisations to participate in CoP.

- The creation of a new model allowing organisations to participate in CoP by using the services of another firm that has technically connected to the CoP environment

- This would then allow the PSPs to be indirectly participating in CoP through an Aggregator.

What further information is available on the Aggregator model?

When will the Aggregator model be ready?

The Aggregator model is ready for applications now – if you are interested in joining through this model, please contact us.

Who can be an Aggregator?

We are opening up the directory for organisations to join the CoP service by extending the eligibility. Now both account holding PSPs and non-account holding PSPs will be able to onboard as a direct participant and offer CoP utilising the aggregator model.

What are the benefits of an Aggregator model?

The key benefit of the new model is to allow more organisations to join CoP and have a choice in how they decide to connect to the CoP directory – either direct or through the Aggregator model. This will help with timing of onboarding but also give PSPs choice in how they connect and meet the SD17 timeline.

When can PSPs start to work with Aggregators to onboard via the Aggregator model?

PSPs and Aggregators can submit their applications to participate in the CoP service in the new directory from April 2024 onwards.

What is Pay.UK’s role with regards to SD17?

Are there potential cost/efficiency advantages to joining via the Aggregator model?

The Aggregator model offers a number of potential advantages in terms of cost and efficiency. Please contact cbdo@wearepay.uk for more details on this. However, each participating firm will have their own criteria to consider when approaching this question.

Cannot find what you need here?

If your question has not been answered, please contact us.